Computer Generated Invoice And Requires No Signature Under Gst

Standard chartered bank has paid the tax and the appellant has also discharged the same to the service provider. It not only evidences the supply of goods or services but is also an essential document for the recipient to avail input tax credit itc.

How To Display Remark This Is Computer Generated Invoice No Signature Required On Every Page

computer generated invoice and requires no signature under gst

computer generated invoice and requires no signature under gst is a summary of the best information with HD images sourced from all the most popular websites in the world. You can access all contents by clicking the download button. If want a higher resolution you can find it on Google Images.

Note: Copyright of all images in computer generated invoice and requires no signature under gst content depends on the source site. We hope you do not use it for commercial purposes.

By way of affixing his digital signature as approved issued under the information technology act 2000.

Computer generated invoice and requires no signature under gst. A registered person cannot avail itc unless he is in possession of a tax invoice. A simplified tax invoice only requires the following information. By hand by the authorised person or.

1 old query new comments are closed. Let me be clear that printed bill books are allowed under gst. By way of affixing his digital signature as approved issued under the information technology act 2000.

Later it was amended to provide that the signature or digital signature of the supplier or his authorized representative shall not be required in the case of issuance of an electronic invoice in accordance with the provisions of the information technology act 2000 21 of 2000. An identifying number e. Simplified tax invoice for amounts under 1000.

Your name address and gst registration number. This is also important for reporting the details to gst system as part of return. Date of issue of invoice.

By hand by the authorized person or. Your bill books may get damaged lost or tempered but with a software using proper backups and security these can be avoided. This rule has been amended to add a proviso which states as under provided also that the signature or digital signature of the supplier or his authorised representative shall not be required in the case of issuance of an electronic invoice in accordance with the provisions of the information technology act 2000 21 of 2000 relevant notification notification no.

It is a common knowledge that any computer generated invoice by the banks does not require signature as the said invoice mentions specifically that this being a computer generated invoice no signature is required. As invoices are being generated online. Operability of e invoices across the entire gst eco system so that e invoices generated by one software can be read by any other software thereby eliminating the need of fresh data entry which is a norm and standard expectation today.

Invoice number description of. The machine readability and uniform interpretation is the key objective. Yes signature is mandatory for invoices under gst.

Refund cannot be denied for want of signature on computer generated invoice. It makes you look more professional. Signature may be in either of the following ways.

The following will not qualify as signature as signed invoices under the gst laws. Pre authentication of computer generated invoice is not required however after invoice is generated through computer system it need to be authenticated. Yes signature is mandatory for invoices under gst.

Under rule 46 of the cgst rules 2017 signature or digital signature of the supplier or his authorized representative was a must on the invoice. The following will not qualify as signature as signed invoices under the gst laws. Signature may be in either of the following ways.

You can order printed books if computer generated invoice is not your first choice. Under gst invoice or tax invoice is an important document. It is the primary document for availing the input tax credit.

The invoice must be authenticated and thus must bear signatures of authorized person. However i will recommend you to use computer generated invoice for your business. You may issue a simplified tax invoice instead of a tax invoice if the total amount payable for your supply including gst does not exceed 1000.

There is no dispute as to the fact that the service provider ms. 742018 central.

Delphi How To Display Remark This Is Computer Generated Invoice No Signature Required On Last Page

This Is Computer Generated Receipt No Signature Required

This Is Computer Generated Receipt No Signature Required

Http Supportsystem Livehelpnow Net Resources 3203 Kb Hazel Aug 202017 How 20to 20display 20remark 20 E2 80 9cthis 20is 20computer 20generated 20invoice 20no 20signature 20required E2 80 9d 20on 20every 20page 20 Pdf

Http Supportsystem Livehelpnow Net Resources 3203 Kb Hazel Aug 202017 How 20to 20display 20remark 20 E2 80 9cthis 20is 20computer 20generated 20invoice 20no 20signature 20required E2 80 9d 20on 20every 20page 20 Pdf

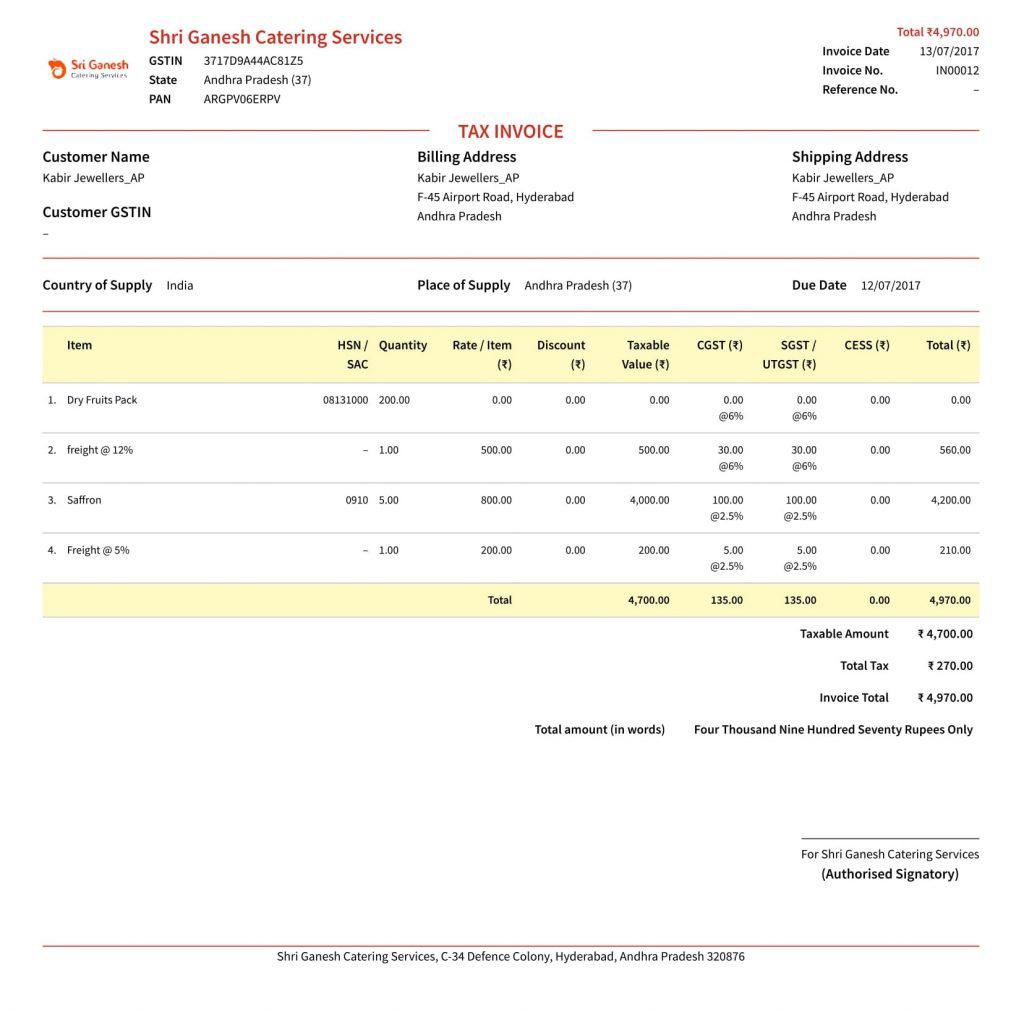

Gst Invoice Guide Learn About Gst Invoice Rules Bill Format

Gst Invoice Guide Learn About Gst Invoice Rules Bill Format

Delphi How To Display Remark This Is Computer Generated Invoice No Signature Required On Last Page

Invoice 2895795464 Pdf Archive

Invoice 2895795464 Pdf Archive

Http Supportsystem Livehelpnow Net Resources 3203 Kb Hazel Aug 202017 How 20to 20display 20remark 20 E2 80 9cthis 20is 20computer 20generated 20invoice 20no 20signature 20required E2 80 9d 20on 20every 20page 20 Pdf

This Is Computer Generated Receipt No Signature Required

This Is Computer Generated Receipt No Signature Required

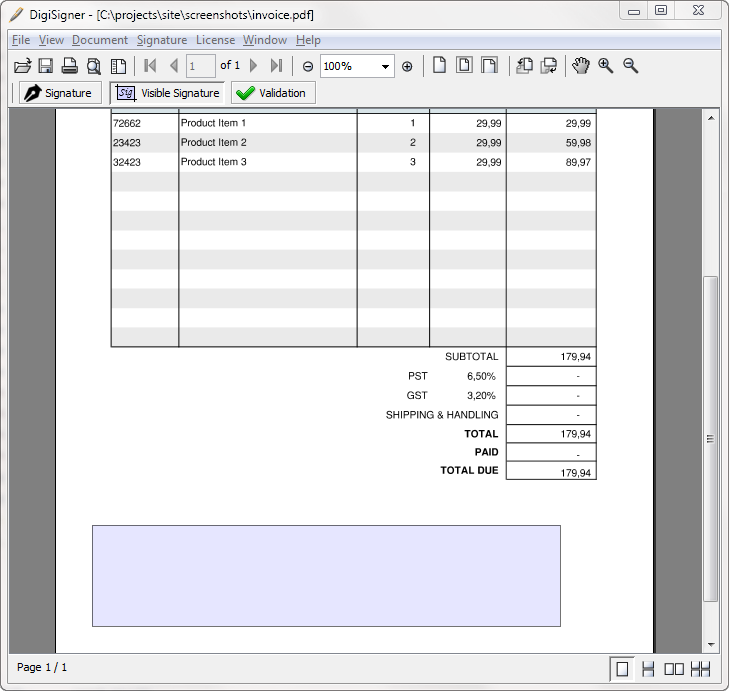

How To Create Digital Signature Using Free Digisigner Tool

How To Create Digital Signature Using Free Digisigner Tool